Applying for a home loan often feels like navigating a maze—filled with endless paperwork, third-party approvals, and fees that seem to come out of nowhere. For decades, the process has remained slow, outdated, and frustrating for buyers across the globe.

Enter Hecksow, a platform that leverages blockchain technology to simplify the mortgage process, reduce costs, and eliminate inefficiencies. Available in New Zealand, the UK, the USA, Australia, and Canada, Hecksow is changing the game by bringing transparency and innovation to homeownership.

Why the Traditional Mortgage Process Needs a Makeover

Let’s face it—the current system is far from perfect. Did you know it takes an average of 42 days to get a mortgage approved and finalized? That’s over a month of dealing with:

- Mortgage brokers

- Bank officers

- Solicitors

- Real estate agents

Each of these professionals adds their own fees and delays to the process. While their tasks, like verifying documents and transferring ownership, are necessary, they rely on outdated systems that could easily be automated.

For example:

- Banks manually verify your income, assets, and debt-to-income ratio.

- Conveyancers conduct title searches and handle property transfers using outdated processes.

These steps lead to long delays, human errors, and higher costs. It’s time for a smarter solution.

How Blockchain Technology Changes the Game

Blockchain mortgages are a groundbreaking innovation that eliminates the inefficiencies of traditional lending. But what is blockchain, and how does it work in homeownership?

At its core, blockchain is a secure, decentralized ledger that records transactions in real time. For mortgages, this means:

- Data Transparency: All relevant mortgage details are stored securely and can be accessed by authorized parties.

- Smart Contracts: Automated contracts execute when specific conditions are met, reducing the need for manual intervention.

- Fraud Prevention: Blockchain creates an unalterable record of transactions, ensuring the integrity of property titles and ownership.

With Hecksow, this technology powers every step of the mortgage process—from pre-approval to finalizing ownership—making it faster, safer, and more affordable.

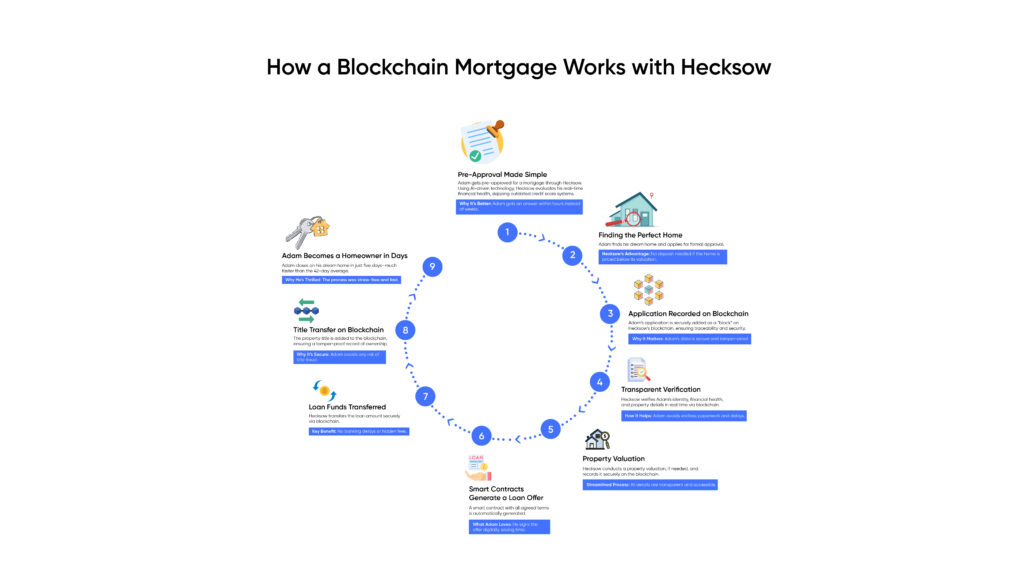

How Blockchain Mortgages Work with Hecksow

Hecksow leverages blockchain to simplify your journey to homeownership. Here’s how it works:

- Pre-Approval: Hecksow uses AI-driven technology to assess your financial health and provide instant pre-approvals. No need for extensive paperwork or credit checks.

- Application Recorded on Blockchain: Your mortgage application is securely recorded on the blockchain, ensuring transparency and traceability.

- Smart Contract Generation: Once approved, a smart contract is created to finalize the loan agreement, automating processes like fund transfers and property title updates.

- Ownership Transfer: The property title is added to the blockchain, providing a tamper-proof record of ownership.

Why Hecksow Is Different

Unlike traditional lenders, Hecksow combines blockchain with cutting-edge AI to remove barriers and create a seamless mortgage experience. Here’s why it stands out:

1. Fast Approvals

Forget waiting weeks—Hecksow reduces the approval process from 42 days to just 5 days, thanks to automated smart contracts and real-time data sharing.

2. Transparent Processes

Every step of your mortgage journey is recorded on the blockchain, giving you full visibility and eliminating hidden fees.

3. Deposit-Free Mortgages

Struggling to save for a deposit? Hecksow offers deposit-free options for homes priced below valuation, removing a significant barrier to homeownership.

4. Global Accessibility

Whether you’re buying a home in New Zealand, the UK, the USA, Australia, or Canada, Hecksow’s global solutions allow you to own property wherever you’re eligible.

5. Enhanced Security

Blockchain’s decentralized nature protects against fraud, ensuring your data and property ownership records are safe.

The Benefits for Buyers

With Hecksow’s blockchain-powered mortgages, you can expect:

- Lower Costs: By eliminating intermediaries, Hecksow saves you money on unnecessary fees.

- Faster Transactions: Smart contracts streamline the process, cutting down approval times significantly.

- Global Opportunities: Buy a home in any country where you’re eligible, without the usual cross-border complexities.

- Greater Security: Blockchain ensures your transactions and ownership records are tamper-proof.

Is Blockchain Mortgage Technology Safe?

Yes! Blockchain technology uses advanced cryptographic protocols to secure your data and transactions. Unlike traditional systems, where human errors can occur, blockchain relies on automated processes to validate and execute contracts.

At Hecksow, we prioritize your security, ensuring that every transaction is transparent and protected.

The Future of Homeownership with Hecksow

Experts predict that blockchain will dominate the real estate industry within the next 5–10 years, and Hecksow is already leading this transformation. By combining AI-driven approvals, deposit-free options, and global accessibility, Hecksow is redefining what it means to buy a home.

If you’ve been waiting for the right time to own your dream home, that time is now. With Hecksow, homeownership is no longer a distant goal—it’s an achievable reality.

Start Your Journey!

Whether you’re in New Zealand, the UK, the USA, Australia, or Canada, Hecksow is here to help you navigate the future of homeownership. Explore our blockchain-powered solutions today and experience a smarter way to own a home.

Reimagine homeownership with Hecksow. Learn more and start your journey today.